12:10 PM

Report: Millennials Have Appetite for Imaging Solutions

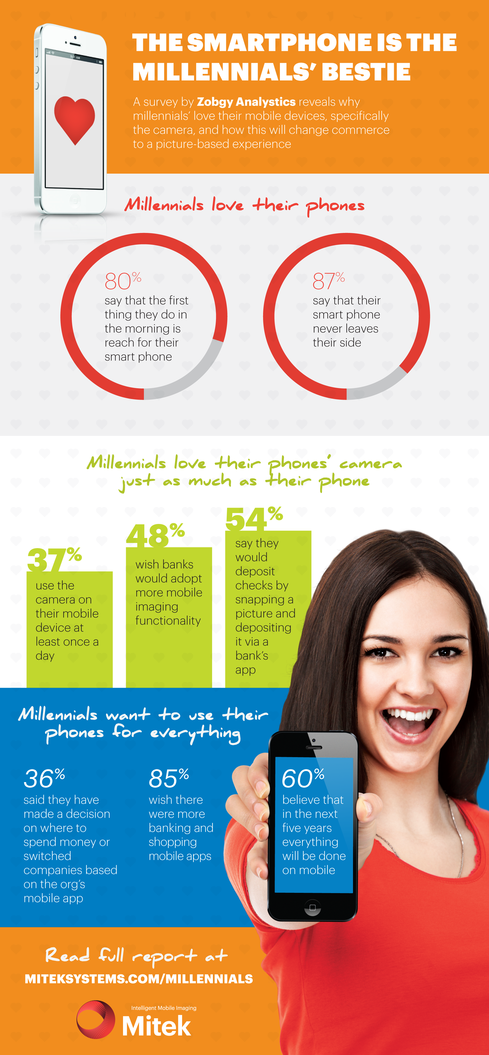

There is a growing appetite among millennials to use their smartphone cameras to conduct a wide array of financial services, according to a survey conducted by Zogby Analytics on behalf of mobile imaging provider Mitek.

The survey polled 1,000 U.S. millennials -- defined as those between the ages of 18 and 34 -- on how they use their smartphones. Unsurprisingly, 87 percent of this demographic reported that their mobile device never leaves their side, while 80 percent say that the first thing they do in the morning is reach for their smartphone.

According to Mitek CEO Jim DeBello, the poll also showed that this demographic increasingly prefers using image-based communication. Mitek is a provider of mobile imaging services for banks.

"The thing that we found enlightening is that it's not just about being mobile, it’s about communicating through images," says DeBello. "It's a shift towards picture-based commerce."

While mobile RDC is fairly commonplace in the consumer banking world these days, the poll results found an appetite among millenials for further image-based services. More than half (54 percent) said they would pay for goods using their mobile devices as mobile wallets, instead of credit cards or checks, if these services were available to them. Also, 45 percent of those polled would pay a bill by taking a picture with a mobile device.

Infographic courtesy Mitek

Additionally, nearly half of the respondents indicated they would be willing to use more imaging services with their banks, such as being able to snap a picture of a driver's license rather than using text to input personal information when signing up for a new service.

"Apple gets this, with what they're doing with Apple Pay," says DeBello, referring to consumers being able to snap a picture of a credit card to upload it to an Apple Pay account, as opposed to entering the information with keystrokes.

DeBello also believes imaging can help bring more financial services to the unbanked, a segment that typically has a high smartphone penetration. An example of this would be a bank employee taking a tablet or other mobile device into a neighborhood and using the camera to capture documentation needed to sign people up for a bank account, he says.

[Join the Women in Technology Panel & Luncheon at Interop on Wednesday, October 1. How different are IT career paths and opportunities for men and women in 2014? Join your peers for an open forum discussing how to advance in an IT organization, keep your skills sharp, and build a mentoring network.]

Bryan Yurcan is associate editor for Bank Systems and Technology. He has worked in various editorial capacities for newspapers and magazines for the past 8 years. After beginning his career as a municipal and courts reporter for daily newspapers in upstate New York, Bryan has ... View Full Bio